Expanding government payrolls have turned the suburbs of Washington, D.C. into some of the most affluent communities in the United States. Under the circumstances, it must have been difficult, these past dozen years or so, for residents to make their way through the city as they headed to a concert or a fine dining spot.

They could easily have run into eighty-year-old Wanda Witter at Thirteenth and G streets NW, with her makeshift sidewalk house of three suitcases, a handcart, and patio chairs. Not a welcome sight if they’ve been fortunate enough to inhabit a higher level on the food chain.

But until just the other day, Ms. Witter was no ordinary homeless person. In fact, she’s spoken of her homelessness as a decision, or more to the point, a “commitment.” And despite the fact she’d been wandering the D.C. streets for years with shopping bags full of papers she’s not afflicted with a mental disorder. In those shopping bags she carried a series of letters she’d received from the Social Security Administration. To anyone who’d listen, she’d insist these letters represented proof the federal government owed her a hundred thousand dollars.

On Tuesday, August 23 Wanda Witter was finally vindicated, when a Social Security check for a hundred thousand dollars, less one dollar, showed up in her account at Sun Trust Bank. Her check was written for the highest lump sum Social Security, by law, is allowed to issue without an extended approval process. The rest that’s due her will be on its way soon. Meanwhile, she was able to use some of the initial payment to get an apartment and stock up on fresh food.

Most people wait till a crisis happens in order to start diversifying their assets. Don’t make that costly mistake. Click here to request Regal Assets’ free gold kit and learn how a portion of your savings in gold can help balance and protect your portfolio against economic uncertainty.

For years, Wanda Witter dogged Social Security by phone and wandered the streets of the nation’s capital with her bags of government correspondence, trying to get someone to help her resolve her drawn-out bureaucratic mess, and trying to maintain her dignity in the process. But she simply was dismissed as a mental case – an old lady carting around junk. In fact, she was for many years a machinist at Ingersoll-Rand and, when she lost her job she went back to school to become a certified paralegal. But no one was hiring.

It took a social worker, Julie Turner, to have enough compassion and patience to go through Witter’s paperwork to understand she was spot on about what Social Security owed her. With Turner’s help, she enlisted the help of Daniela de la Piedra, an attorney specializing in Social Security disputes.

I think we’re kidding ourselves if we simply write off Wanda Witter’s misfortune as a glitch in the system. Let’s use a more accurate name. I prefer “American nightmare.”

Americans looking to retire have come to rely on what U.S. Representative Sander Levin refers to as “a three-legged stool” – Social Security, employer-provided pension funds, and private savings.

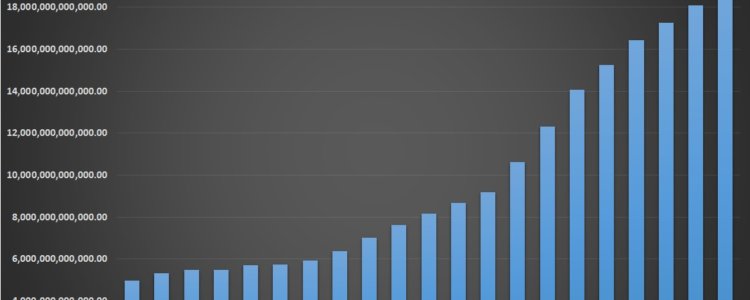

You’ve frequently read criticism in this blog about all three of these sources of retirement funds. Social Security has become congress’s mandatory game of dodge-ball during a debate about the national debt. Some claim Social Security benefits are due to decrease, some say the age of eligibility for benefits should be raised, and still others say the whole shebang should be privatized.

Meanwhile private pension funds are fast going the way of the dodo. They’ve just about been replaced by defined contribution plans like the 401(k), which put the entire investment risk on the employee. As for private saving plans, the rates of interest range from anemic to outrageous.

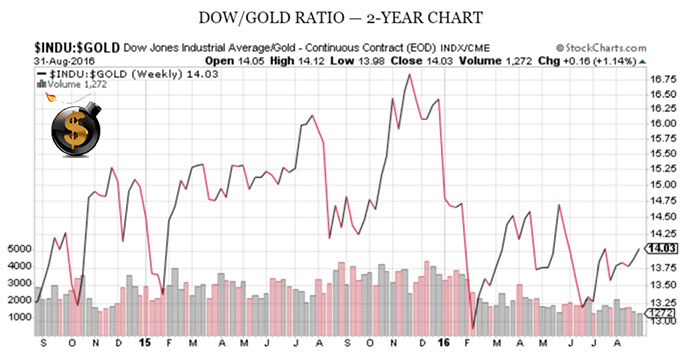

Clearly, if you want a profitable and dignified retirement, you’re going to need something a heck of a lot less shaky than the no-longer-structurally-sound three-legged stool. Priced attractively in its support range, gold currently provides an impressive upside opportunity, which explains the meteoric rise in gold IRA rollovers. With central banks printing money like there’s no tomorrow, the dollars you’re saving are going to eventually disappoint you if you don’t diversify to more stable assets.