If you have been following the news in Europe lately, you may have heard that Italian banks are in trouble. A few weeks ago, the Financial Times revealed that non performing (or bad) loans comprise 18% of all the bank loans in Italy today.

That number compares to the U.S. banks’ 5% non performing loan ratio from the peak of the Financial Crisis back in 2008-2009. It means the Italian banks have over three times as many bad loans as their American counterparts did in the worst financial crisis since the Great Depression.

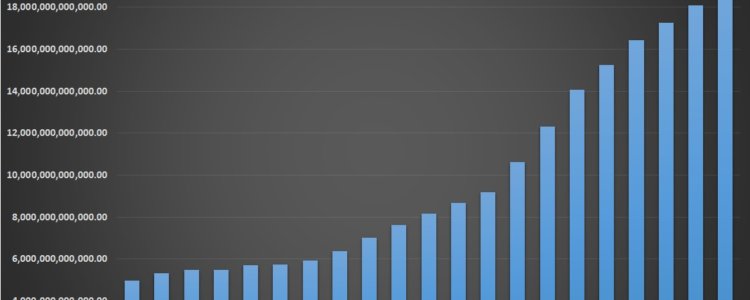

This situation spiraled out of control in the five year period from 2010 to 2015 as the amounts of non performing loans Italian banks had rocketed up by 85% to an incredible 360 billion euros. The shocking part is that the Italian banks lost control of the situation after the financial crisis had already ended.

The Wall Street Journal has also weighed in at the end of July on how the Italian banking crisis became so severe. It turns out that the bad loans have risen by 50 billion euros per year after the financial crisis because the banks did not want to write off the bad assets.

The Italian banks and government officials hoped that a more powerful recovery would cause at least some of the borrowers’ financial situations to improve. This way they could repay their loans. At the same time, they figured that banks profits would then improve enough to lessen the blow from bad loan write offs.

The big problem is that the they never saw a significant recovery in Italy (or in much of the European Union for that matter). The 80 billion euros injected into the Italian banks by occasional market recapitalizing disappeared. Continuing financial problems and reduced bank profitability devoured them.

Negative interest rates from the European Central Bank have only aggravated the situation as banks in Italy and most of Europe have to pay 4 euros for every 1,000 euros they keep at the central bank. This adds up fast when you are talking about billions and even trillions of euros.

The banking problem is not confined to Italy either. Look at the first quarter profits for other major European banks.

The Spanish international bank BBVA saw its profits decline by 54%. Germany’s largest financial institution Deutsche Bank saw its profits plunge 58%. Even legendary international Swiss bank UBS suffered an eye watering 64% drop.

This matters to you for several crucial reasons. These major international banks are all connected by complicated financial risk and insurance policies called credit default swaps. When banks in Italy and the rest of Europe suffer catastrophic losses, it affects financial institutions around the world, including the U.S.

A banking crisis in Italy, one of the G7 largest economies of the world, can also be the spark that ignites a stock market pullback or crash not only in Europe but also in the United States.

Don’t forget about the stability of the European Union, the world’s largest economic block by several measures. The EU has taken a blow from Britain voting to leave the European project. It can not weather an Italian banking crisis that potentially spreads contagion to the rest of the block.

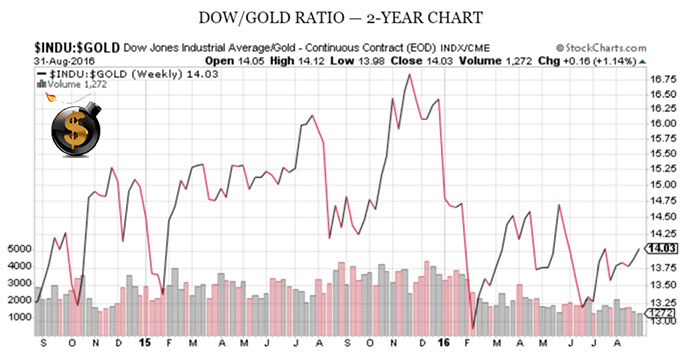

Gold is your answer to the financial problems that plague Italian and other European banks. By putting a portion of your assets into the safe haven metal that has withstood countless banking crises over the centuries, you can help hedge your portfolio and retirement assets against financial market turbulence.