The euro is a disaster.

At least that’s the story according to Joseph Stiglitz, the Nobel prize-winning economist.

Looking at Europe, it’s not difficult to see what he means. Greece is drowning in one of the biggest debt crises in history. Italian banks are verging on collapse. And Germany is struggling under the pressure of vicious negative interest rates.

If even one of these dominos fall, Europe could go up in flames.

There’s a good reason why Britain voted to distance itself from the fragile continent. But even the Brexit vote threw fuel on the fire, casting its own banks into uncertainty.

Over here in the US, it’s like watching a car crash in slow motion. But we are not immune from the troubles in Europe. Our economies and our banks are intimately linked.

If the European banks crumble, you’d better believe it will create a financial tsunami. And that tidal wave is heading straight across the Atlantic.

Perhaps it’s time to prepare for the worst.

Panic in Italy

The crisis in Italy looks terrifying similar to the one in the US just before the 2008 financial crisis.

The country’s banks are sitting on €360 billion worth of bad loans. That’s a fifth of Italy’s GDP. The banks claim the bad loans are worth 45%–50% of their original value. But in reality, it’s closer to 20% according to Steve Eisman, the man who predicted the US banking collapse.

Sound familiar? That’s because US banks did the same thing. They wrapped up junk loans and sold them as AAA bonds, vastly overselling their true worth. And we all know how that turned out.

If the Italian banks acknowledge the real value of these loans, they could go broke overnight.

Italy’s worst performing bank, Banca Monte dei Paschi di Siena, is most vulnerable. It has already been bailed out by taxpayers (to the tune of €4 billion) and raised a further €8 billion from investors. But it needs more.

The Italian government is ready to provide a handout but hasn’t yet ironed out the details. The bank’s only other option would be to close a €5 billion deal with private investors by mid-January.

If that fails, the bank may be forced to consider a bail-in, requiring shareholders or even depositors to foot the bill.

There’s another problem too. Italy just threw itself into a political whirlwind. In a referendum earlier this month, Italians voted to reject constitutional changes proposed by Prime Minister Matteo Renzi. Renzi promptly resigned, leaving a political void and economic uncertainty.

In the short term, it may scare off private investors who are so desperately needed by Monte dei Paschi. But there’s a bigger long-term threat. The referendum rejection was driven by the populist party, Five Star. The organization is hellbent on yanking Italy out of the eurozone. There’s a chance they’ll gain power next year, and that could spell the end of the euro.

Of course there are more than a few steps before we reach that fate. But after the populist uprising in Britain and America this year, it’s not unimaginable.

Unfortunately, the trouble doesn’t end with Italy.

Deutsche Bank Is the Biggest Risk

Germany is Europe’s largest economy, and Deutsche Bank (DB) is its largest bank. According to the IMF, DB “appears to be the most important net contributor to systemic risks.” Whatever happens there may have a global ripple effect.

The bank is already unstable, with negative interest rates eating away its revenue. The biggest challenge, however, is a possible US$14 billion fine being imposed by the US Department of Justice.

The fine threatens to cripple the bank, but Angela Merkel said “nein” to any hint of a bailout. That leaves Deutsche Bank in a tough spot. Either raise enough capital to pay the fine, go bust, or instigate a bail-in. In other words, force the bank’s depositors to pay the price.

Brexit

To round off the deadly cocktail, Brexit has thrown the UK’s banks into years of uncertainty. Just last month, the Royal Bank of Scotland failed a stress test. In part, due to the instability created by the referendum.

The Brexit effect is already being felt by US banks. JPMorgan Chase, Goldman Sachs, Bank of America, Citigroup, and Morgan Stanley are now moving operations out of Britain. They need a new legal home in the EU.

But that won’t come cheap. The cost and logistics of moving will be significant. Worse, the EU announced last month that foreign banks must increase their liquidity and capital to operate on the continent. Bottom line: Banking in the EU is about to get more expensive for US institutions.

The Domino Effect

Institutions like Deutsche Bank are intimately woven into the US economy. Just take a look at this IMF-produced diagram that shows how deeply connected Deutsche Bank is to US banks.

If there is a collapse, it will have an immediate effect on US institutions.

The threat of slow growth and sliding GDP is also weighing heavily on the US. As a result of the Brexit vote alone, economists revised the US GDP growth down.

Make no mistake; economic problems in Europe are contagious. Investor appetite will begin to weaken. Mergers and acquisitions will slow down. It will squeeze bank profits on both sides of the Atlantic.

Economic uncertainty will also keep US interest rates low, strangling growth at home. The Fed has already delayed planned rate hikes this year due to global instability.

If the US is doomed to wallow in low interest rates for longer, banks will have to settle for lower returns. Or worse, they’ll take bigger risks with your money to draw profit.

Time for an Escape Plan?

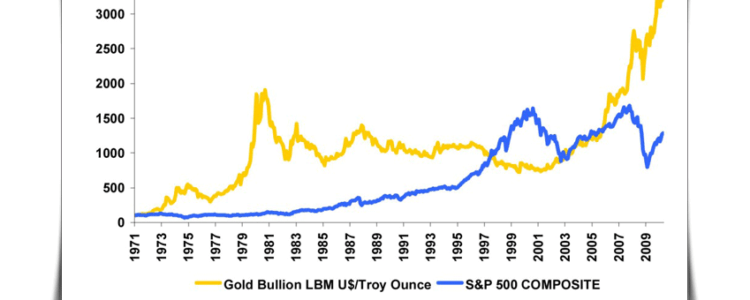

Gold Investment is the alternative currency that can safeguard you from these types of events. Putting a portion of your savings into this precious metal will help protect you. Download your free self directed IRA rollover gold IRA information kit today.